👋 Hey, here's what we can do for you:

Employees get more awesome benefits 🔥

Doesn't change/replace any existing ones 🚫

Employer can save a ton on payroll taxes 💰

Employees can get extra take-home pay 😍

Can reduce self-funded insurance costs 🎉

Could lower Workers Comp premiums 📉

No work/effort required to implement 😎

Zero out-of-pocket costs to get started ✅

Super fast, simple and easy to maintain 😴

Helps employer recruit, grow & retain 🚀

Includes legal opinions from top firms ⚖️

Multiple Fortune 500 clients on board 🏢

So What's The Catch?

Well, this bolt-on benefits program is obviously not "free," and as with anything, it also has to be done compliantly...

...but considering this doesn't change or replace anything, and is fully funded out of a portion of the tax savings, all we need from you is a simple payroll census report to calculate the exact bottomline savings that this can generate.

Give More Benefits (At No Net Cost To The Company) To Encourage Better Health

Employees get access to top tier healthcare perks (that don't change any benefits currently in place - 100% funded from the tax savings).

Increase Employee Loyalty To Grow Revenue And Help With Recruiting & Retention

Offering more benefits and an increase in take-home pay provides a real competitive advantage when it comes to attracting talented employees.

Increase Profitability By Reducing Your FICA Taxes (And Your Worker's Comp)

By incentivizing preventative healthcare, the employer leverages incentives in the tax code to create tax savings that increase their bottom line.

This might still sound too good to be true, but we have many Fortune 500 clients (who do a LOT of due diligence) such as McDonalds as well as small businesses, nonprofits, and even municipalities implementing this program.

So if you’re skeptical (which is totally fine), then all we’re asking for here is the opportunity to prove how this works, answer any questions you have, and explain why it’s different from anything else you've ever seen before. 💯

Here's why this opportunity exists right now...

One of the primary objectives that governments have is to create "aligned incentives." Meaning that they'll pass legislation that encourages employers to do things for their employees as well as their local community in exchange for tax savings or growth opportunities.

Some of those incentive programs are found in certain sections of the tax code as well as more recent updates made in the Affordable Care Act.

The reality is that healthcare in the US has become a tremendous financial burden on our society (~$4.5 trillion last year alone), so to help mitigate these growing issues, there are many incentives in the tax code that encourage "preventive care." With the end goal of lowering the amount of demand there currently is on the public healthcare system.

Here's why this opportunity exists right now...

One of the primary objectives that governments have is to create "aligned incentives." Meaning that they'll pass legislation that encourages employers to do things for their employees as well as their local community in exchange for tax savings or growth opportunities.

Some of those incentive programs are found in certain sections of the tax code as well as more recent updates made in the Affordable Care Act.

The reality is that healthcare in the US has become a tremendous financial burden on our society ($4.5 trillion last year alone), so to help mitigate these growing issues, there are many incentives in the tax code that encourage "preventive care." With the end goal of lowering the amount of demand there currently is on the public healthcare system.

And if they choose to adopt our employee benefits program...

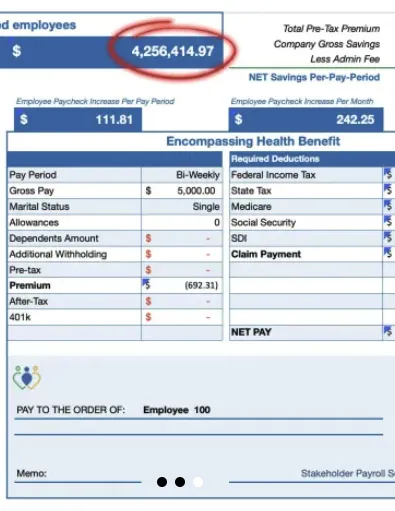

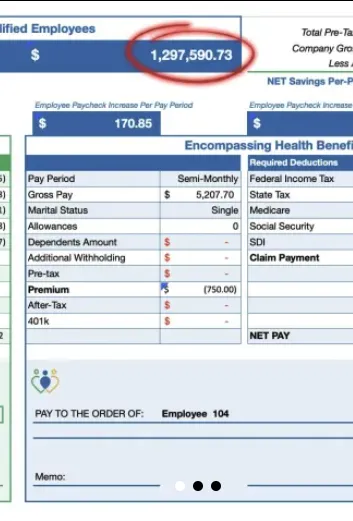

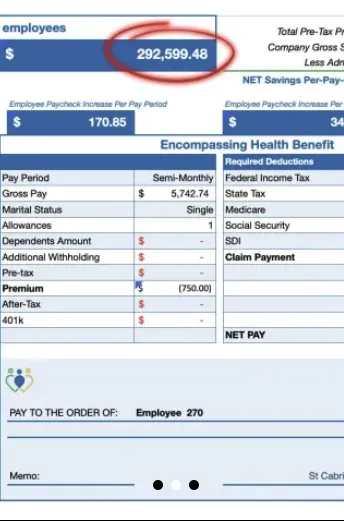

The end result is that the employer can save up to $900 per employee per year in payroll taxes (based on wages)...

As well as potentially reducing the cost of their Worker's Comp premiums (varies state by state)...

And it can even potentially result in an increase in take-home pay for the employees as well...

Likewise, it doesn't disrupt or change any benefits currently in place (this just bolts on), and aside from providing one simple payroll report, it doesn't require any work/effort to implement or maintain.

Payroll service stays the same. More benefits bolt on. Healthcare improves. Taxes go down. Employees love it. Everybody wins.

Plus our team does all the setup and compliance work. Easy peasy.

(And the only thing you have to do is help get this in front of the person who would make a decision on it). 🤔

And if they choose to adopt our employee wellness program...

The end result is that the employer can typically save between $650 to $900 per employee per year in payroll taxes...

As well as potentially reducing the cost of their Worker's Comp premiums (varies state by state)...

And it can even result in an increase in take-home pay for the employees as well...

Likewise, it doesn't disrupt or change any benefits currently in place (this just bolts on), and aside from providing one simple payroll report, it doesn't require any work/effort to implement or maintain.

Payroll service stays the same. More benefits bolt on. Healthcare improves. Taxes go down. Employees love it. Everybody wins.

Plus our team does all the setup and compliance work. Easy peasy.

(And the only thing you have to do is help get this in front of the person who would make a decision on it). 🤔

Want a complimentary 3-7 night vacation just for giving us a shot and booking a demo call?

We know you're busy, so as a gesture of appreciation for your time, we partnered with one of the best travel agencies in the US to give us the ability to GIVE YOU a complimentary 3-7 night vacation (annually) to one of over 80+ worldwide destinations.

And before you ask - no, there's no time share pitch... 🤣

We're so confident that this will be an absolute no-brainer that we're willing to do whatever it takes to get you to take a closer look to see if it really is as good as we say it is. (It is).

*Hotel taxes not included - we tried, but local city and state governments declined our requests haha... Considering we can significantly reduce your federal payroll taxes, they weren't as flexible on the local stuff. Likewise, this just covers the cost of the hotel rooms - airfare, taxes, food, tips, resort fees, entertainment, etc are not included.

Want a complimentary 3-7 night vacation just for giving us a shot and booking a demo call?

We know you're busy, so as a gesture of appreciation for your time, we partnered with one of the best travel agencies in the US to give us the ability to GIVE YOU a complimentary 3-7 night vacation (annually) to one of over 80+ worldwide destinations.

And before you ask - no, there's no time share pitch... 🤣

We're so confident that this will be an absolute no-brainer that we're willing to do whatever it takes to get you to take a closer look to see if it really is as good as we say it is. (It is).

*Hotel taxes not included - we tried, but local city and state governments declined our requests haha... Considering we can significantly reduce your federal payroll taxes, they weren't as flexible on the local stuff. Likewise, this just covers the cost of the hotel rooms - airfare, taxes, food, tips, resort fees, entertainment, etc are not included.

Want us to reduce even more of your business and personal expenses with guaranteed results?

Would you rather give everyone on your team a raise or instead just help them lower their cost of living?

Now more than ever, people are feeling the pressure of rising costs with inflation. What if you could provide your team the ability to save upwards of 30-50%+ or more on all of their monthly bills? (And yours too, BTW).

By leveraging proprietary data from over 25,000+ audits, our team of cost reduction experts is able to determine true market rates, and will negotiate better prices on you and your team's behalf. Results are literally guaranteed and 100% of the work is done-for-them without any upfront cost or commitment. 💯

Frustrated with rising costs and inflation? Obliterate your team's monthly bills with ease...

Would you rather give everyone on your team a raise or instead just help them lower their cost of living?

Now more than ever, people are feeling the pressure of rising costs with inflation. What if you could provide your team the ability to save upwards of 30-50%+ or more on all of their monthly bills? (And yours too, BTW).

By leveraging proprietary data from over 25,000+ audits, our team of cost reduction experts is able to determine true market rates, and will negotiate better prices on you and your team's behalf. Results are literally guaranteed and 100% of the work is done-for-them without any upfront cost or commitment. 💯

Hear what people have to say:

Ashley Zeitz

"Finding Benifyts.com is the best thing we've done for our company in a long time. Our employees love everything about this program and so do we.

Craig Miller

"THEY ARE THE BEST! I am so excited with how incredible this program is. Literally everyone in the company has benefited from implementing this."

Jenny Lee

"Benifyts.com has saved the company millions of dollars and is by far our new favorite vendor ever since we started working with them."

Marcus Aradon

"This is the best thing ever. Most salespeople always try to harp on how what they offer is 'win-win' but this is legitimately that... EVERYONE benefits."

Tanisha Franklin

"How are more people not aware of this?! The benefits are a no brainer and it just keeps getting better every month. I wish we found them years ago!"

Thomas Reeder

"I am so grateful Lindsay at Benifyts.com reached out to us. Our team is making more money, the company is saving money, and everyone is stoked."

Brooklyn Yi

"Honestly I was a little bit skeptical when I first heard about this, but once I saw the caliber of clients they have, we pulled the trigger and haven't looked back."

James Studdart

"I manage a small team and handle a lot of the hiring and HR in the company we work for. Everyone is super grateful we implemented this."

Hear what people had to say:

Ashley Zeitz

"Finding Benifyts.com is the best thing we've done for our company in a long time. Our employees love everything about this program and so do we.

Craig Miller

"THEY ARE THE BEST! I am so excited with how incredible this program is. Literally everyone in the company has benefited from implementing this."

Jenny Lee

"Benifyts.com has saved the company millions of dollars and is by far our new favorite vendor ever since we started working with them."

Marcus Aradon

"This is the best thing ever. Most salespeople always try to harp on how what they offer is 'win-win' but this is legitimately that... EVERYONE benefits."

Tanisha Franklin

"How are more people not aware of this?! The benefits are a no brainer and it just keeps getting better every month. I wish we found them years ago!

Thomas Reeder

"I am so grateful Lindsay at Benifyts.com reached out to us. Our team is making more money, the company is saving money, and everyone is stoked."

Brooklyn Yi

"Honestly I was a little bit skeptical when I first heard about this, but once I saw the caliber of clients they have, we pulled the trigger and haven't looked back."

James Studdart

"I manage a small team and handle a lot of the hiring and HR in the company we work for. Everyone is super grateful we implemented this."

Do you have more questions about how these hubs work?

One of our dedicated benefits & incentives specialists would be happy to collaborate with you to identify which of perks would work best for your company.

We can activate or de-activate certain features in your hub if there's a conflict of interest or you don't think it would be something your team would be interested in, or we can just give them access to everything.

The beauty of this is that once your portal has been built (which we do for you), the only other thing you have to do is share it with all of the people you care about and then experience how grateful they are, and how much longer they continue doing business with you - whether as an employee or customer.

Here's How And Why This Works:

Here's How And Why This Works:

Imagine being able to incentivize Literally Anything You Want...

Whether you want more reviews, customers, sales, referrals, ambitious employees to hire, etc, you can now incentivize virtually anything you want by just giving away something that everyone wants. 🛩️ 🏖️

And before you ask, no there's no timeshare pitch looming when they get there. These resorts are all 4+ star Trip Advisor-rated hotels in 80+ locations.

All of which results in an incredible valuable gift, a truly memorable experience for the recipient, and a lifetime of reciprocity for giving it to them. 😍

Imagine being able to incentivize Literally Anything You Want...

Whether you want more reviews, customers, sales, referrals, ambitious employees to hire, etc, you can now incentivize virtually anything you want by just giving away something that everyone wants. 🛩️ 🏖️

And before you ask, no there's no timeshare pitch looming when they get there. These resorts are all 4+ star Trip Advisor-rated hotels in 80+ locations.

All of which results in an incredible valuable gift, a truly memorable experience for the recipient, and a lifetime of reciprocity for giving it to them. 😍

So what's the catch?

The most common response that we hear is that "

this sounds too good to be true..."

Well there is one catch - as much as we've tried to convince governments around the world how swell it would be if they would also consider donating the hotel fees & taxes, they all... um... declined.

Typical governments... 🏛️ 🙄

So what does that mean? It means you (or your new best friend) still gets a 3 to 8+ night vacation (easily worth thousands of dollars) for roughly the cost of a restaurant dinner. 👌

So what's the catch?

The most common response that we hear is that "this sounds too good to be true..."

Well there is one catch - as much as we've tried to convince governments around the world how swell it would be if they would also consider donating the hotel fees & taxes, they all... um... declined.

Typical governments... 🏛️ 🙄

So what does that mean? It means you (or your new best friend) still gets a whopping 3 to 8+ night vacation (easily worth thousands of dollars) for roughly the cost of a decent restaurant dinner. 👌

Hear what They had to say

And if you REALLY want to treat someone special (like your best employee or your favorite customer), you could even cover the measly taxes for them. ❤️

Everyone loves getting a great deal and winning a vacation that is easily worth thousands of dollars (and priceless memories for their family) is no brainer for anyone when you set the right expectations upfront.

And if for some reason you still don't believe us, then why'd you read this far? Was it for the free vacation we mentioned at the top? 😉

Just listen to these testimonials (you get to use this video too) and imagine being able to give away an unlimited number of these to incentivize anything else you want from your employees & customers!

Greg & Stacy Atley

"The staff is amazing. They make you feel like a VIP, Like everyone knows you. The beaches are beautiful. The food is amazing. And we saved over $3000..."

Jason & Nicole Stone

"We literally saved $1000s of dollars. Thank you for helping us to celebrate this milestone for our marriage, Thanks we will definitely be booking again!"

Kimberly & Tom Soren

"We booked our stay here at beautiful Westgate here in Orlando. The booking was so easy. The stay was beautiful. We couldn't have asked for anything more."

Jennifer & Billy Larkin

"Incredibly beautiful beaches. Great food. Outstanding service. We’ve had a wonderful vacation. We highly recommend it. It’s just beautiful here!"

Hear what They had to say

And if you REALLY want to treat someone special (like your best employee or your favorite customer), you could even cover the measly taxes for them. ❤️

Everyone loves getting a great deal and winning a vacation that is easily worth thousands of dollars (and priceless memories for their family) is no brainer for anyone when you set the right expectations upfront.

And if for some reason you still don't believe us, then why'd you read this far? Was it for the free vacation we mentioned earlier? 😉

Just listen to these testimonials (because you get to use this video too) and imagine being able to give away unlimited vacations to incentivize anything else you want from someone!

Frequently Asked Questions

How much does it cost?

There is no true net cost for the employer or qualified employees. The program is fully funded out of the tax savings that are generated by implementing this program. We have a couple different options based on client preferences, but there will never be any upfront or out-of-pocket costs to implement this, and the additional tax savings and reduced expenses drop straight to the bottom line increasing profitability and enterprise value. 📈

How does this help?

This program can help solve recruitment, retention, and revenue concerns and/or goals that employers have. It gives them a competitive edge by offering additional benefits and perks that can help recruit talented employees to grow the company and retain them for longer compared to other companies that don't offer these types of benefits and incentives. 🧲

How does it work?

All our team needs is a simple payroll report called a "census" to calculate the projected tax savings (confidential info can be redacted). Then, assuming you want to move forward, a simple payroll integration is set up via API (we handle that with your payroll department/service). Then we'll spend a couple weeks to help explain how the program works to the employees as well as the additional benefits that they now have access to, and that's pretty much it. 🙌

Does this impact or change our current benefits?

Nope, this program does not change or replace anything you currently have in place - it is purely an enhancement. So whether your organization currently offer benefits or not, this program basically just bolts on. 🔩🔧

Is this compliant?

Yes absolutely - compliance is critically important with these types of programs. Understanding and following the tax code as it's written is the single most important factor, because if it's done incorrectly, it defeats the purpose of the tax savings and incentives. For that reason, we have multiple legal opinion letters as well as backing from an A-rated insurance carrier (who is literally in the business of calculating risk). Likewise, it has also passed the legal teams of many Fortune 500 clients - which means A LOT of due diligence has been done it. That said, we're happy to provide you with every ERISA document, tax code citation, and legal opinion that you could possibly need to make an educated decision on a program like this. 👩💻

How do we get started?

Feel free to submit a form on our website and someone will reach out asap (5-10 min Q&A call). If you're interested, they'll set you up with a comprehensive presentation with a licensed advisor. After that, it takes our onboarding team approximately 3-5 weeks to get your payroll integrations set up/educate the employee base, but then it's pretty much hands off from there. 🚀

Have Additional Questions? Our Experts Are Here To Help!

Give our team a call at (844) 989-0001 or email hello@joinallies.org!

Or feel free to send us a contact request using the form below:

Ready To Book A Quick Q&A Call?

Hey, thanks for stopping by.

Interested in our referral program?

© Copyright 2024+ JoinAllies.org | Legal | ID 884322591

YouTube and the YouTube logo are registered trademarks of Google Inc. This site is not affiliated with YouTube or Google Inc. in any way. This site is not a part of the Facebook™ website or Facebook™ Inc. Additionally, this site is NOT endorsed by Facebook™ in any way. FACEBOOK™ is a trademark of FACEBOOK™, Inc. Anyway, even though our fancy pants attorneys are so successful that they have their own attorneys, and despite the fact that we don't own anything because any assets that we (or our hundreds of entities) may or may not have ever owned (including but not limited to our 11-in-1 Instant Pot/Air Fryer combo) have been stashed away in either Nevis or the Cook Islands so ambulance-chasing opportunists can eat their hearts out, but despite all that our persnickety prosecuting proxies STILL insisted we include the following legalese: Copyright © JoinAllies.org. All rights reserved. No part of this content may be reproduced or transmitted in any form or by any means without written permission from JoinAllies.org. This content is for educational purposes only and all information shared are the sole thoughts and opinions of the author. Neither this email, nor any content provided by our organization, is intended to provide personalized legal, tax, financial, investment, and definitely not medical advice. We are not selling or soliciting a security in any way, shape, or form. You should probably seek professional advice before taking any further action. Seriously. We have no idea what we're doing, but for some reason it keeps working.

Our Pricing

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Donec nec gravida enim. Vestibulum

MONTHLY

FREE FOREVER

Lorem ipsum dolor sit

Features1

Features2

Features3

Features4

Features5

$0/mo

MONTHLY

Essential

Lorem ipsum dolor sit

Features1

Features2

Features3

Features4

Features5

$97/mo.

MONTHLY

Premium

Lorem ipsum dolor sit

Features1

Features2

Features3

Features4

Features5

$497 /mo.

© Copyright 2021. Company Name. All rights reserved.

MONTHLY

Basic

Lorem ipsum dolor sit

Features1

Features2

Features3

Features4

Features5

$0/mo FREE FOREVER

MONTHLY

Basic

Lorem ipsum dolor sit

Features1

Features2

Features3

Features4

Features5

$0/mo FREE FOREVER

MONTHLY

Premium

Lorem ipsum dolor sit

Features1

Features2

Features3

Features4

Features5

$497 /mo.

About the owners, Nick and Haley Apollo

"As a business owner, it is always important to know the numbers and statistics in your company. To know your best clients, programs, what is working or not working. Many of us spend years and thousands of dollars on software that we think will help, and spend too much money, time and effort to implement. And if we can’t understand it all, we have to invest/pay another person to understand and implement it all.

As a subscriber to multiple software platforms to keep our businesses at the forefront of the industry, I can truly share this software developed by High Level, makes my job as the CEO a simpler one. Meaning I can see new clients coming in the door from multiple resources, our company follow up, conversions, current client’s information, sales, and special offers in one place."

RepAllies.com replaces the core functionality (and costs!) of all this software:

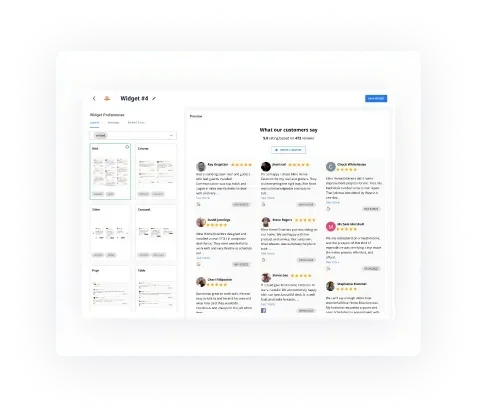

Reputation Marketing

What good is a reputation if you don’t show it off? Add social proof to any website with our review widget. And auto-post your best reviews to social media.

Review Social Proof Widgets

In-Content Embed Style Review Widget

Website Hover Review Widget

Automatically Post Reviews to Social Media

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

#1 Automation Software in the Market. Built by small business owners, for small business owners.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Morbi viverra, velit in luctus fermentum

Lorem ipsum dolor

Our Solution

For You Business

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Donec nec gravida enim. Vestibulum pulvinar velit id dui malesuada rutrum. Integer eu nibh risus. Maecenas ut arcu ipsum. Pellentesque quis aliquet velit, id faucibus dolor. Sed vitae imperdiet nisi.

Reputation Management

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Donec nec gravida enim. Vestibulum pulvinar velit id dui

Unified Messaging

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Donec nec gravida enim. Vestibulum pulvinar velit id dui

Appointment Automation

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Donec nec gravida enim. Vestibulum pulvinar velit id dui

Lead Management

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Donec nec gravida enim. Vestibulum pulvinar velit id dui

Our Pricing

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Donec nec gravida enim. Vestibulum

MONTHLY

Basic

Lorem ipsum dolor sit

Features1

Features2

Features3

Features4

Features5

$0/mo FREE FOREVER

MONTHLY

Essential

Lorem ipsum dolor sit

Features1

Features2

Features3

Features4

Features5

$297 /mo.

MONTHLY

Premium

Lorem ipsum dolor sit

Features1

Features2

Features3

Features4

Features5

$497 /mo.

MONTHLY

Basic

Lorem ipsum dolor sit

Features1

Features2

Features3

Features4

Features5

$0/mo FREE FOREVER

MONTHLY

Basic

Lorem ipsum dolor sit

Features1

Features2

Features3

Features4

Features5

$0/mo FREE FOREVER

MONTHLY

Premium

Lorem ipsum dolor sit

Features1

Features2

Features3

Features4

Features5

$497 /mo.

MONTHLY

Free Forever

Lorem ipsum dolor sit

Features1

Features2

Features3

Features4

Features5

$0/mo

MONTHLY

Professional

Lorem ipsum dolor sit

Features1

Features2

Features3

Features4

Features5

$97/mo.

MONTHLY

Premium

Lorem ipsum dolor sit

Features1

Features2

Features3

Features4

Features5